American Rescue Plan Act of 2021 Texas Homeowner Assistance Fund Program (TXHAF)

INFORMATIONAL PURPOSES ONLY: The information provided on this website does not, and is not intended to, constitute legal advice; instead, all information, content, and materials available on this site are for general informational purposes only. Information on this website may not constitute the most up-to-date legal or other information. This website contains links to other third-party websites. Such links are only for the convenience of the reader, user or browser; this Firm does not recommend or endorse the contents of the third-party sites.

Texas Homeowner Assistance Fund (TXHAF) is part of the

American Rescue Plan Act of 2021. TXHAF provides eligible

homeowners with grants to pay past due mortgage payments and

property taxes, insurance, and HOA fees.

How to apply:

They started taking applications on 3/2/2022 and homeowners can apply online at https://www.texashomeownerassistance.com/.

Who is eligible?

Texas homeowners may be eligible for assistance under TXHAF if they meet the following:

- Have fallen behind on one or more payments: mortgage, property tax, property insurance, HOA/condo association fees.

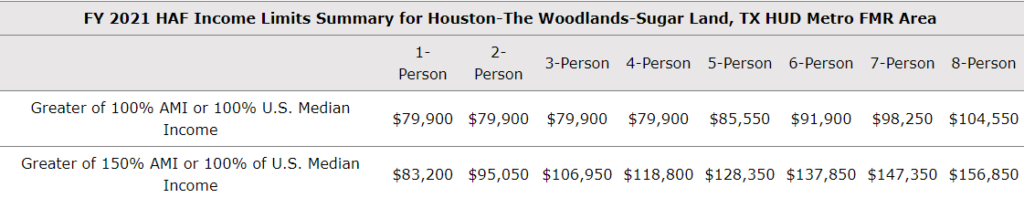

- Household income at or below 100% Area Median Income (AMI) or 100% of the median income for the United States, whichever is greater

- Houston-The Woodlands-Sugar Land, TX HUD Metro FMR Area (Income Limits)

- Own and occupy their home in Texas as their primary residence

- Household experienced a qualified financial hardship after January 21, 2020, such as lost income or increased expenses due to the pandemic

Payments are made:

- Once a homeowner’s application is approved, payment is sent directly to the mortgage servicer, property tax authority, insurance company, or HOA/condo association.

- Payment is made by either ACH/ direct deposit or check

Recent Posts